Last day to apply for Motisons Jewellers IPO

Motisons Jewellers IPO has become the most trending IPO as soon as it has arrived for the listing in the market. But why is that? There are number of reasons for this.

This company book its profits from various kinds its products like Gold, Diamond, Kundan, Pearl, Silver, Platinum and other gems and metal ornaments. The company was started in 1997 and have a very stable foundation and strong presence in Jaipur, Rajasthan region.

The biggest reason why this IPO is famous is because of its PE ratio. The IPO PE ratio is just 17 Rupees whereas its peers companies like Kalyan Jewellers (PE: 66.93), Senco Jewellers (PE: 37.27), Titan (PE: 97.7) have a much higher PE ratio than Motisons Jewellers. Another factor is the highest 189% premium in the Grey Market sector in which its competitor companies have given a premium: Titan (45%), Kalyan Jewellers (145%), Senco (85%). These 2 reasons have made this IPO famous between the retail investors.

IPO Details:

Bidding Dates: 18-Dec,2023 to 20-Dec, 2023

Lot Size: 250 Shares

Price Range: 52-55 INR

Issue Size: 151.09 Cr.

Some Useful Links: Red Herring Documents filed with ROC

| Subscription Status | |

| Qualified Institutional Buyers | 0.66 times subscription |

| Non-Institutional Investors | 69.59 times subscription |

| Retail individual Investors | 64.37 times subscription |

| Sum Total | 51.36 times subscription |

Motisons Jewellers IPO opens for subscription — listen in to ET NOW's Ashesha for more details.@Ashesha_A pic.twitter.com/sMVDxojl5P

— ET NOW (@ETNOWlive) December 18, 2023

Assets

- Rising trend in assets from year 2021 – 2023

- From 417 Cr. to 574 Cr. in 2 years duration

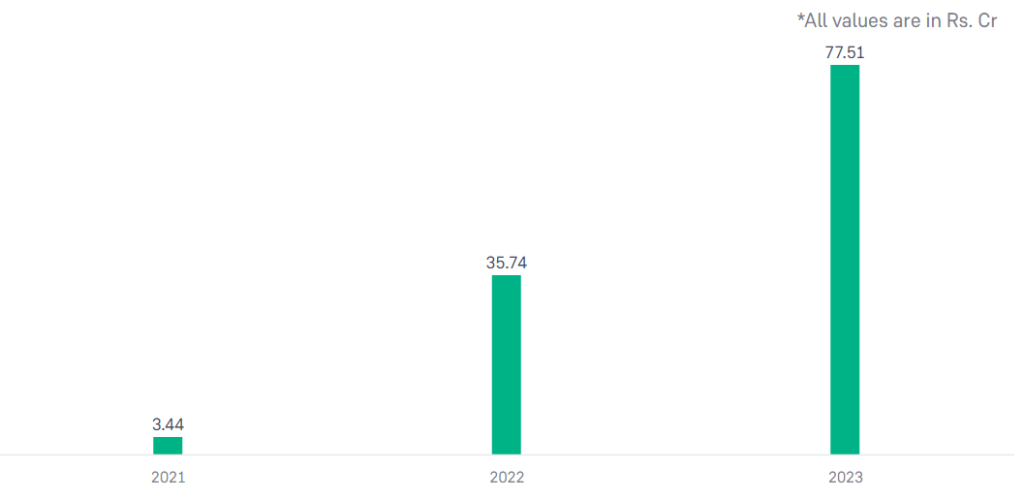

Profits

- Rising trend in profits from year 2021 – 2023

- From 3.44 Cr. (2021) -> 35.74 Cr. (2022) -> 77.51 Cr. (2023)

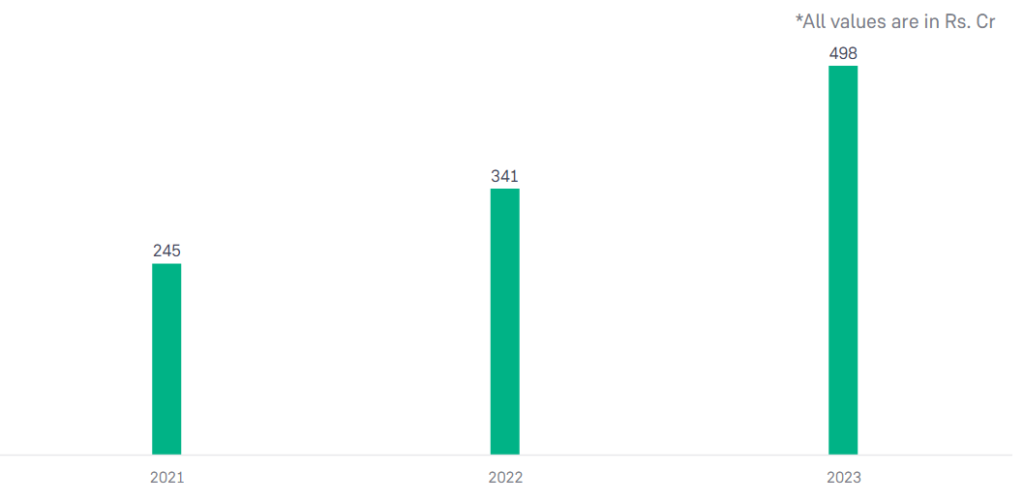

Revenue

- Rising trend in Revenue from year 2021 – 2023

- From 245 Cr. to 498 Cr. almost double the revenue in just 2 Years.

How soon can I apply for this IPO?

You can apply for it right now. IPO will close on 20-Dec-2023 at 4:50 PM.

What will be the issue size of this IPO?

151.09 Cr.

What is the amount and the number of shares in one lot size?

The lot size is 250 shares with the amount at cut off prize of 13,750 INR.

Where can I apply for this IPO?

There are number of trading platforms available online like Angel One, Groww, Upstox etc. from which you can apply for this IPO.

https://groww.in/ipo/motisons-jewellers-ipo

Leave a Reply